First Nations Bank of Canada (FNBC.Service@fnbc.ca) bills itself as ‘the only Indigenous-led national bank in Canada’. Fintrac imposed a penalty of $601,139.80 on September 22, 2025 for 5 violations under Canada’s anti-money laundering laws.

A compliance examination found the bank failed to submit suspicious transaction reports in 31% of the case files it reviewed where there were reasonable grounds to suspect transactions were related to money laundering or terrorist activity financing. It also said the bank did not develop and apply written compliance policies and procedures.

Fintrac says the bank failed to assess and document the risk of money laundering or terrorist financing and failed to take prescribed special measures with it’s high-risk clients. FNBC failed to conduct ongoing monitoring of business relationships.

FNBC was established in 1996 in Saskatchewan. It was an alliance of the Saskatchewan Indian Equity Foundation, the fully disgraced FSIN, and TD Bank. The first branch opened in Saskatoon and it has its head office there. The bank officially de-coupled from TD Bank in 2012. The bank is majority owned by 78 Indigenous shareholders that hold over 80% ownership interest in the shares of the bank. On June 5, 2025 FNBC and the Business Development Bank of Canada (BDC) announced a $100M initiative to increase business acquisitions by Indigenous communities. On August 22, 2025 FNBC announced it was raising $10m in equity financing. $9m appeared.

|

Bill Lomax is President & CEO. (Bill.lomax@fnbc.ca) |

|

Jed Johns is Chief Marketing Officer. (Jed.johns@fnbc.ca). |

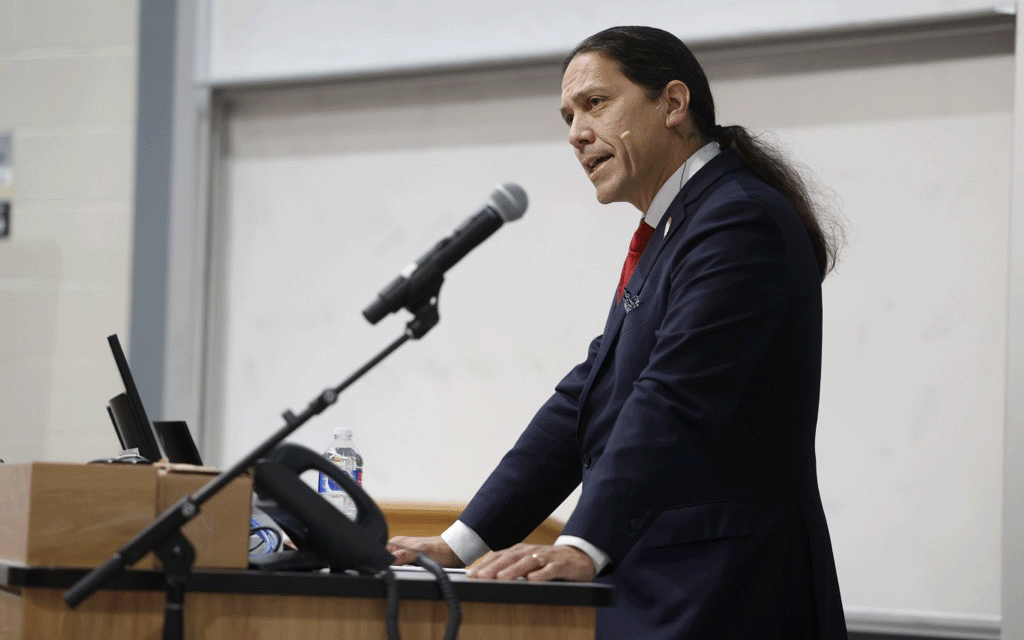

He says the clown bank has improved its compliance, including hiring a chief compliance officer. Laughably dysfunctional BoD is Here. Chair is Perry Bellegarde, who assumed the top chair in April 2024.

(pbellegarde@fasken.com) He is a ‘special adviser’ to law firm Fasken of the Sandher Crime Family.

Leave a Reply