Omai Gold cuts 708m @ 1.06 g/t Au from 365m

2025-12-18 08:25 ET – News Release

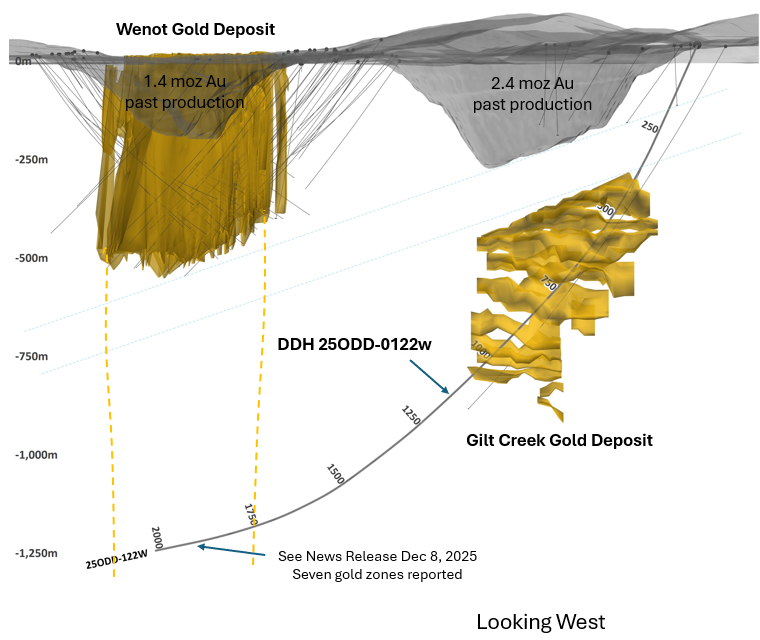

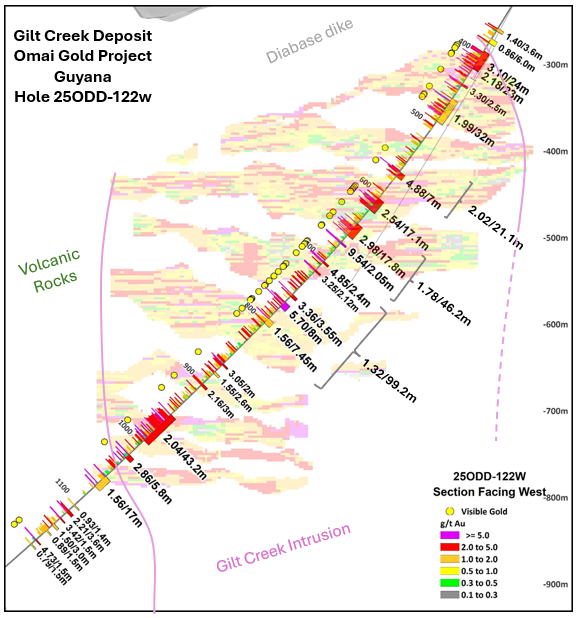

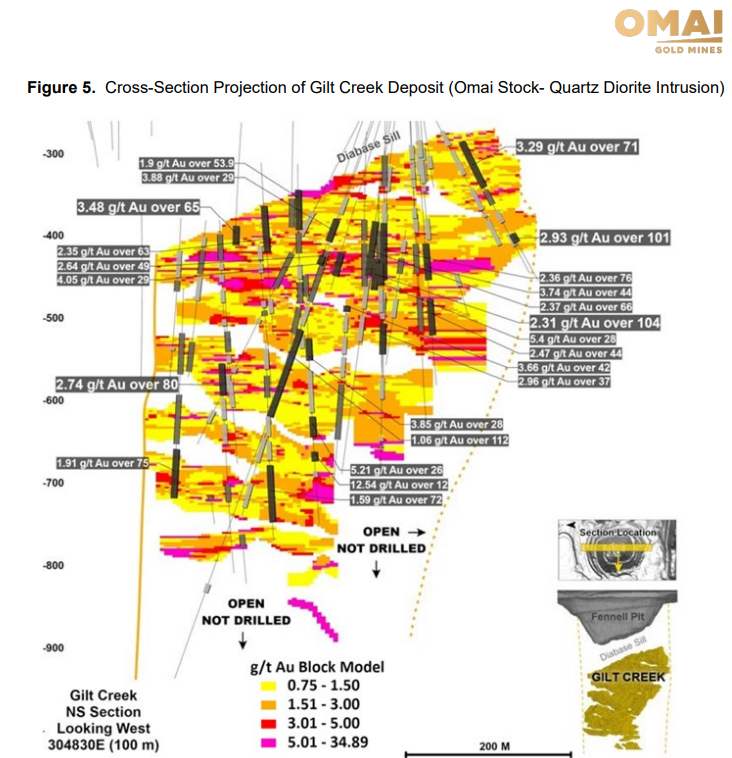

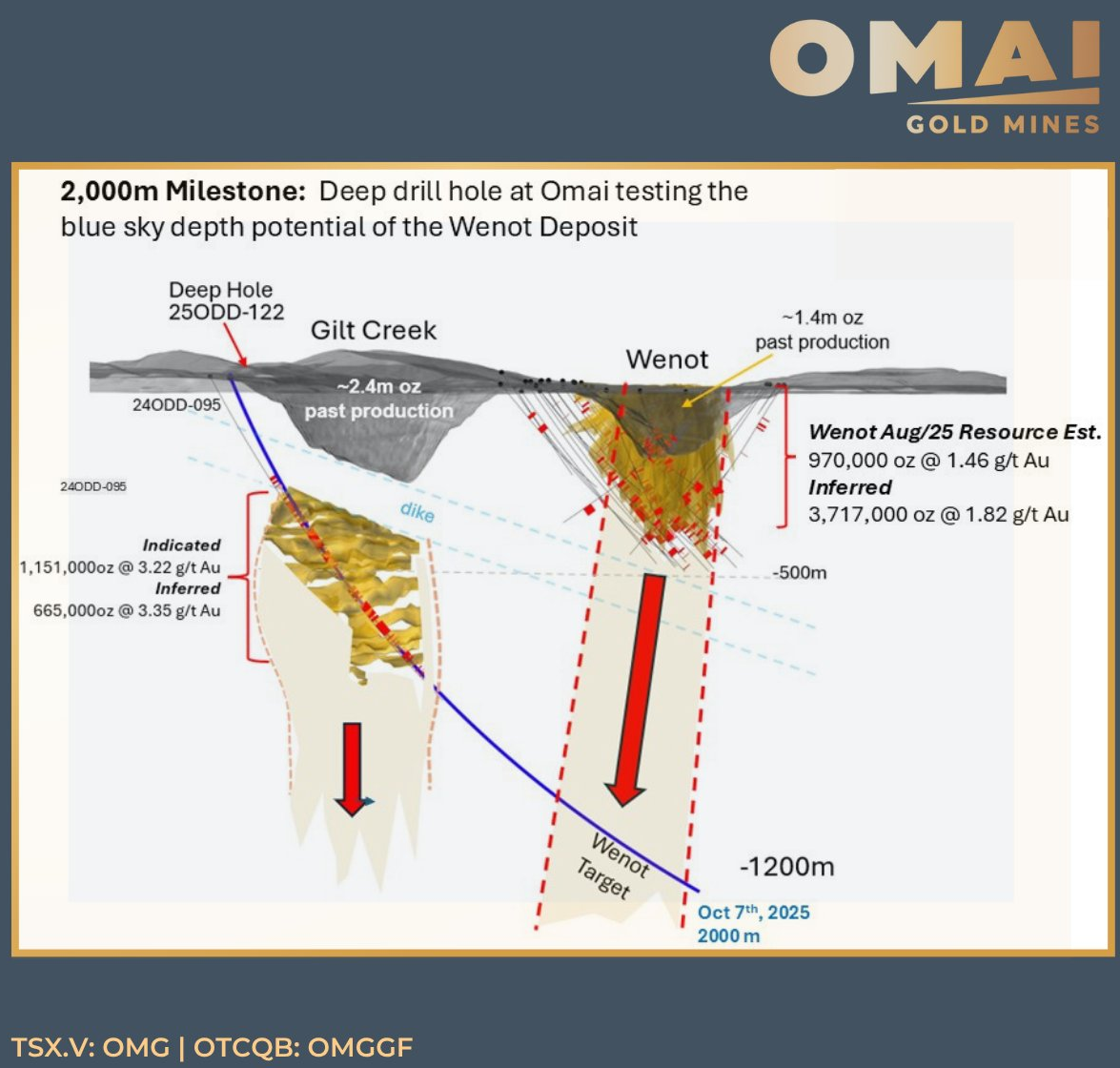

Toronto, Ontario–(Newsfile Corp. – December 18, 2025) – Omai Gold Mines Corp. (TSXV: OMG) (OTCQB: OMGGF) (“Omai Gold” or the “Company“) is pleased to announce assay results from the Company’s second hole drilled on the Gilt Creek gold deposit. The Gilt Creek deposit is one of two orogenic gold deposits at its 100%-owned Omai Gold Project in Guyana. Hole 25ODD-122(w) drilled 708m of the Omai Stock, an intrusive rock unit that produced 2.4 million ounces of gold between 1993-20052 from the upper portion from surface to a vertical depth of approximately 250m. Hole 25ODD-122(w) was drilled from surface to a total depth of 2,014m with results previously report for the lower part of the hole that confirmed the presence of the adjacent Wenot deposit at a depth of approximately 1,200m, or 700m below the known Wenot gold mineralization. Hole 122w showed that the Wenot shear at this depth hosted seven significant gold zones (news release November 12, 2025). The upper part of hole 122(w) was drilled from surface through a mafic volcanic sequence, then through the known diabase dike, and first intersected significant gold mineralization at a vertical depth of approximately 260m. Gold mineralization proved extensive throughout the Gilt Creek intrusion and extends into the surrounding volcanic rocks as well. A 708.1m interval in Hole 122(w) averaged 1.06 g/t Au with multiple intervals with higher grades, as shown in figure 1, Table 1 and as highlighted below:

Highlighted higher grade zones from the upper part of hole 25ODD-122w include:

- 1.06 g/t Au over 708.1m (from 364.9) includes

- 1.78 g/t Au over 46.2m (from 635.6 downhole) includes

- 4.88 g/t Au over 7.0m (from 566.3m)

- 1.32 g/t Au over 99.2m (from 702.0m) includes

- 5.7 g/t Au over 8.0m (from 766.9m)

- 3.10 g/t Au over 24.0m (from 395.5m)

- 1.99 g/t Au over 32.0m (from 462.0m)

- 2.98 g/t Au over 17.8m (from 643.8m)

- 2.04 g/t Au over 43.2m (from 952.2m)

- 1.78 g/t Au over 46.2m (from 635.6 downhole) includes

Visible Gold in Quartz Vein within Gilt Creek Gold Deposit (Hole 122W @ 652.7m-and 656.1m – and 1333.1m – bottom)

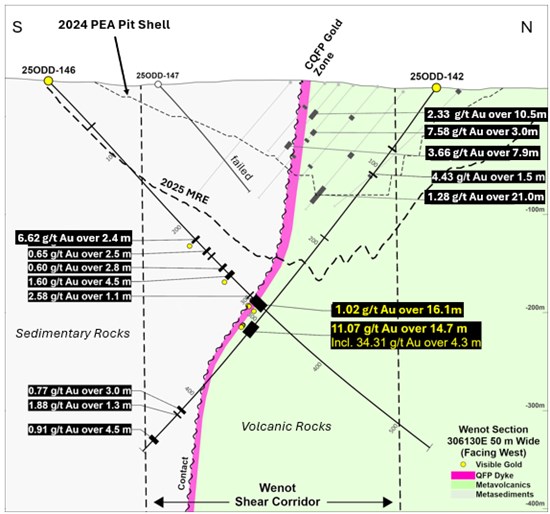

December 8, 2025 – Omai Gold Mines Corp. (TSXV: OMG) is pleased to announce assay results from the current drilling program at its 100% owned Omai Gold Project in Guyana, South America. Significant mineralization was intersected in central Wenot (13.54 g/t Au over 13.3m in Hole 145W) and in a new wide high-grade zone at East Wenot (11.07 g/t Au over 14.7m in Hole 142)).

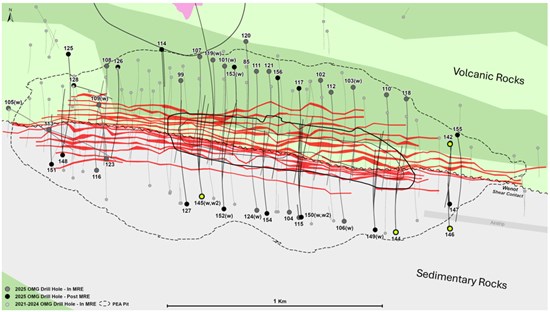

A total of 79 holes (35,300m) have been completed on the Omai project in 2025. Of these, 30 holes (13,250m) completed or underway on Wenot, are not included in the recent August 2025 updated Mineral Resource Estimate (“MRE“). These will contribute to an updated MRE planned for early 2026, in advance of the updated Preliminary Economic Assessment (“PEA“) expected in H1 2026. Five rigs are currently drilling on the Wenot deposit, continuing to focus on areas that have the potential to further expand the resource and optimize the upcoming PEA. The Company is pleased to report that it has exceeded its target of completing an additional 10,000m of drilling, post the August MRE, by year end.

Highlights* from the recent drilling include:

- Hole 25ODD-142 (East Wenot)

- 11.07 g/t Au over 14.7m

- Including 34.31 g/t Au over 4.3m

- 11.07 g/t Au over 14.7m

- Hole 25ODD-145W (Central Wenot)

- 13.54 g/t Au over 13.3m

- Including 27.82 g/t Au over 6.2m

- Including 63.17 g/t Au over 2.2m

- 2.01 g/t Au over 15.0m

- 13.54 g/t Au over 13.3m

- Hole 25ODD-144 (East Wenot)

- 1.11 g/t Au over 31.6m

- 0.98 g/t Au over 12.0m

- 0.99 g/t Au over 13.0m

- Hole 25ODD-146 (East Wenot)

- 6.62 g/t Au over 2.4m

- 1.02 g/t Au over 16.1m

- Hole 25ODD-140 (Camp Zone)

- 2.63 g/t Au over 5.5m

- Including 6.06 g/t Au over 2.3m

- 2.63 g/t Au over 5.5m

..

https://www.stockwatch.com/News/Item/Z-C!OMG-3763248/C/OMG

https://omaigoldmines.com/corporate-presentation/

Omai Gold’s Deep Hole Intersects 2.57 g/t Au over 8.6m and 5.12 g/t Au over 3.6m, 700m Below Wenot Gold Deposit.

November 12, 2025 – Omai Gold Mines Corp. is pleased to announce assay results from the deep drill hole (25ODD-122W) testing the depth potential of the Wenot Gold Deposit at its 100% owned Omai Gold Project in Guyana, South America. The hole intersected multiple gold zones within the down dip extension of the Wenot Shear Corridor at a depth of approximately 700m below the known Wenot deposit. The Wenot Shear Corridor hosts the large Wenot gold deposit that has been identified to a maximum depth of 530m. The upper part of hole 122W intersected 699m of the Gilt Creek deposit, then continued and encountered the Wenot Shear Corridor at approximately 1,739m downhole with the shearing continuing until the end of the hole at 2,014m. Seven discrete gold zones were intersected within broader lower-grade envelopes. The last zone downhole, returning 2.19 g/t Au over 7.9m (including 3.61 g/t Au over 4.4m), ended at 2,009.8m, less than five metres from the end of the hole. The hole ended still within the Wenot Shear Corridor but could not continue due to excessive flattening. The final depth reached exceeded expectations, but it is likely that the shear zone continues further.

Highlights from Lower Part of Hole 25ODD-122W, includes multiple gold zones:

(intersections below are between 1,785.0m to 2,009.8m downhole (see Table 1), or at a vertical depth from surface of between 1,220m and 1,280m)

2.57 g/t Au over 8.6m

5.12 g/t Au over 3.6m

2.19 g/t Au over 7.9m, including 3.61 g/t Au over 4.4m

3.34 g/t Au over 4.5m

1.80 g/t Au over 5.5m

1.23 g/t Au over 4.6m

2.07 g/t Au over 3.3m

Here.

Omai Gold Mines Corp. is a Canadian gold exploration and development company focused on its 100%-owned Omai Gold Project in Guyana, South America. The project hosts two adjacent orogenic gold deposits. An updated NI43-101 Mineral Resource Estimate of 4.4 million oz (Inferred) at 1.95 g/t Au (in 69.6Mt) plus 2.1 million oz (Indicated) at 2.07 g/t Au (in 31.9Mt) was announced August 25, 2025.

https://www.stockwatch.com/Quote/Detail?C:OMG

The Omai Gold Mine produced over 3.7 million ounces of gold from 1993 to 2005, ceasing operations when gold was below US$400 per ounce. The Omai site benefits from existing infrastructure and will soon be connected to the two largest cities in Guyana, Georgetown and Linden, via paved road.

October 3, 2025 – OMAI GOLD MINES CORP. ANNOUNCES UPSIZE OF PREVIOUSLY ANNOUNCED BOUGHT DEAL PRIVATE PLACEMENT TO $40 MILLION

Omai Gold Mines Corp., due to investor demand, and Paradigm Capital Inc., as lead underwriter and sole bookrunner, on behalf of a syndicate of underwriters, have agreed to increase the size of the company’s previously announced bought deal private placement offering. Under the amended offering, 34,783,000 common shares of the company are to be issued at $1.15 per share for gross proceeds of $40,000,450. In connection with the upsize of the offering, the company and Paradigm have also agreed that the previously announced underwriters’ option (as such term is defined in the news release of the company dated Sept. 30, 2025) shall no longer apply to the offering.

———————————————–

Ms. Elaine Ellingham reports

OMAI GOLD MINES CORP. ANNOUNCES $30 MILLION BOUGHT DEAL PRIVATE PLACEMENT OF COMMON SHARES

Omai Gold Mines Corp. has entered into an agreement with Paradigm Capital Inc., as lead underwriter and sole bookrunner, on behalf of a syndicate of underwriters to be formed, in connection with a bought deal private placement offering of 26,087,000 common shares of the company to be issued at $1.15 per share for gross proceeds of $30,000,050.

In addition, the underwriters have been granted an option to purchase up to 3,913,050 additional shares for additional gross proceeds of up to $4,500,008.

The net proceeds from the offering will be used for exploration and development, and general working capital purposes.

In connection with the offering, the company has agreed to pay the underwriters a fee of 5.5 per cent of the gross proceeds from the sale of the shares. The company will have the right to include a list of subscribers to purchase up to $1.5-million of the shares at the issue price under the offering. The underwriters will receive a reduced underwriters’ fee of 3 per cent of the gross proceeds from the sale of the shares to the president’s list.

The offering is expected to close on or about Oct. 21, 2025, and is subject to certain closing conditions, including, but not limited to, the receipt of all necessary approvals, including the conditional listing approval of the TSX Venture Exchange and the applicable securities regulatory authorities. The offering is being made by way of private placement in Canada, in the United States pursuant to an exemption from the registration requirements of the United States Securities Act of 1933, as amended, and in such other jurisdictions as may be mutually agreed upon by the underwriters and the company. The securities issued under the offering will be subject to a hold period in Canada expiring four months and one day from the closing date of the offering.

Globe says new coverage rates Omai Gold Mines “buy”

2025-08-20 04:03 ET – In the News

“The Globe and Mail reports in its Friday, Aug. 29, edition that Stifel analyst Cole McGill commenced coverage on Omai Gold Mines with a “buy” recommendation and a $1.40 share target. The Globe’s David Leeder writes in the Eye On Equities column that analysts on average target the shares at $1.82. Mr. McGill says in a note: “Our investment thesis on Omai is underpinned by a rare combination of scale, grade and infrastructure in an emerging jurisdiction (Guyana now ninth, up from 22nd in 2022 on Fraser Institute rankings for mining investment attractiveness) with one of the best gold discovery rates in the Americas. Omai Gold’s 100-per-cent owned, brownfield Omai gold project already hosts 6.5 MMoz Au at 1.99 g/t Au, placing Omai in a select group of plus-5MMoz, 2g/t Au gold deposits not already owned by a producer (just two in the Americas) with plus-300kozpa Au, +15 year life of mine potential. With the Guiana Shield receiving renewed interest in recent years, we think Omai’s combination of rapid ounce growth and healthy in country acquisition multiples support increased asset value.”

Elaine Ellingham, President & CEO, Executive Chairman is a director of Alamos Gold Inc. AGI.t

https://www.stockwatch.com/Quote/Detail?C:AGI

On October 10, 2025 Company updated deep hole drilling.

“Our deep hole testing both Gilt Creek & Wenot’s blue-sky depth potential just hit 2,000 m!”

https://x.com/OmaiGoldMines/status/1975944366716846537

On Sept 24th, 2025 Co announced that assays are pending for the upper part of the hole and sampling of the lower part awaited completion of drilling.